Exploring Careers with PA Career Zone

Exploring Careers with PA Career Zone

Throughout April, we are celebrating Financial Capability Month by featuring a variety of financial education programs and resources that you can put to use in your classroom right away. The third of these programs is PA Career Zone. Career exploration is an important part of the educational - and financial - process. After all, it is hard to manage money, if you aren’t earning any. Go beyond “what do you want to do when you grow up” using the Pennsylvania Department of Education’s PA Career Zone. In addition to the tools for students, educators can also set up accounts and access additional resources. Below are some of the key features of the PA Career Zone site, or watch a site overview tour here:

- Assessments - Career Zone offers four different self-assessments to help students focus in on their interest, skills, and what’s important to them in a job.

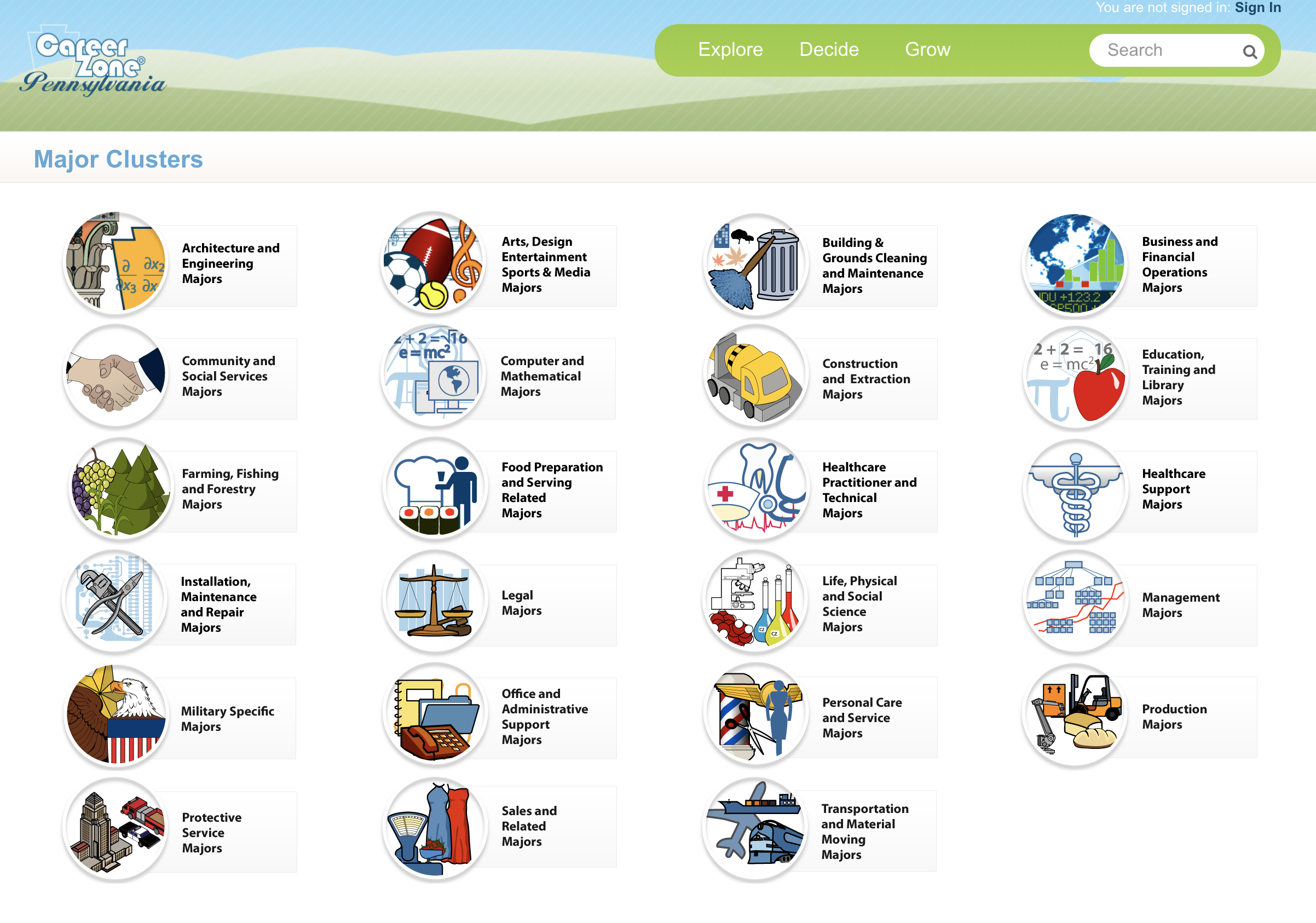

Job Information - Students can explore jobs by looking at 23 broad sectors or career clusters or filter over 950 jobs by income, job family, STEM (Science, Technology, Engineering, and Math), and high priority occupations.

Job Information - Students can explore jobs by looking at 23 broad sectors or career clusters or filter over 950 jobs by income, job family, STEM (Science, Technology, Engineering, and Math), and high priority occupations. - Job Application Tools - Students can build printable resumes, cover letters, and reference lists (free log-in required to access). To use these, students should create a user account so their information can be stored for future use.

- Financial Tools - From the cost of college to developing a budget to understanding financial aid, Career Zone also looks at the financial implications of seeking higher education and living on a specific salary.

- Up the Ladder - Designed for elementary and middle school students, Up the Ladder is a game that requires students to be logged in. You can watch a preview of the game here. Students earn badges for exploring different careers.

Many financial educators love the two options for budgeting offered by Career Zone.  In Choose Your Lifestyle, students begin by selecting the Pennsylvania county in which they plan to live and then make choices for housing, utilities, food, insurance, and more. Each is customized to the cost of living in the area they selected. Once completed, the student sees a chart of their monthly budget and are informed of the annual salary they will need to earn in order to support their chosen lifestyle. The other budgeting option is Pick Your Salary. As the title suggests, students begin by selecting a salary on a scale. They go through the same selections as the previous option, but this time each expense is subtracted from their income. Will they be able to live the lifestyle they want or will they need to make tough choices? Look for more featured resources throughout April: Financial Capability Month.

In Choose Your Lifestyle, students begin by selecting the Pennsylvania county in which they plan to live and then make choices for housing, utilities, food, insurance, and more. Each is customized to the cost of living in the area they selected. Once completed, the student sees a chart of their monthly budget and are informed of the annual salary they will need to earn in order to support their chosen lifestyle. The other budgeting option is Pick Your Salary. As the title suggests, students begin by selecting a salary on a scale. They go through the same selections as the previous option, but this time each expense is subtracted from their income. Will they be able to live the lifestyle they want or will they need to make tough choices? Look for more featured resources throughout April: Financial Capability Month.